Table of Contents

1. Elon Musk buying Twitter

In April of 2022, you couldn’t open up your newsfeed without being bombarded with news of Elon’s offer to buy Twitter, the very platform he used to rock the markets.

Perhaps more shocking than Musk’s price offer of $44 billion for Twitter was the effect the announcement had on his own companies. After the initial tweet, Tesla’s stocks lost nearly $40 billion in value within just one day.

2. Buying in bulk at GameStop

Early in 2021, members of the Reddit subreddit r/wallstreetbets forum started to support GameStop, which caused the stock to surge as more investors purchased shares.

Then, on January 26, Elon Musk commented with the straightforward tweet “GameStonk!!.” To help spread the word about the impact the message board was having on the stock, he included a link to the r/wallstreetbets subreddit. Shares of the gaming company increased 50% as a result.

GameStop was purchased as part of the Reddit group’s “short squeeze,” which required investors who had shorted the stock, like hedge funds, to repurchase it at a loss.

Prior to soaring to an all-time high of $347.51 on January 27 — the day after Musk’s tweet — the stock began 2021 at $17.25. And despite that

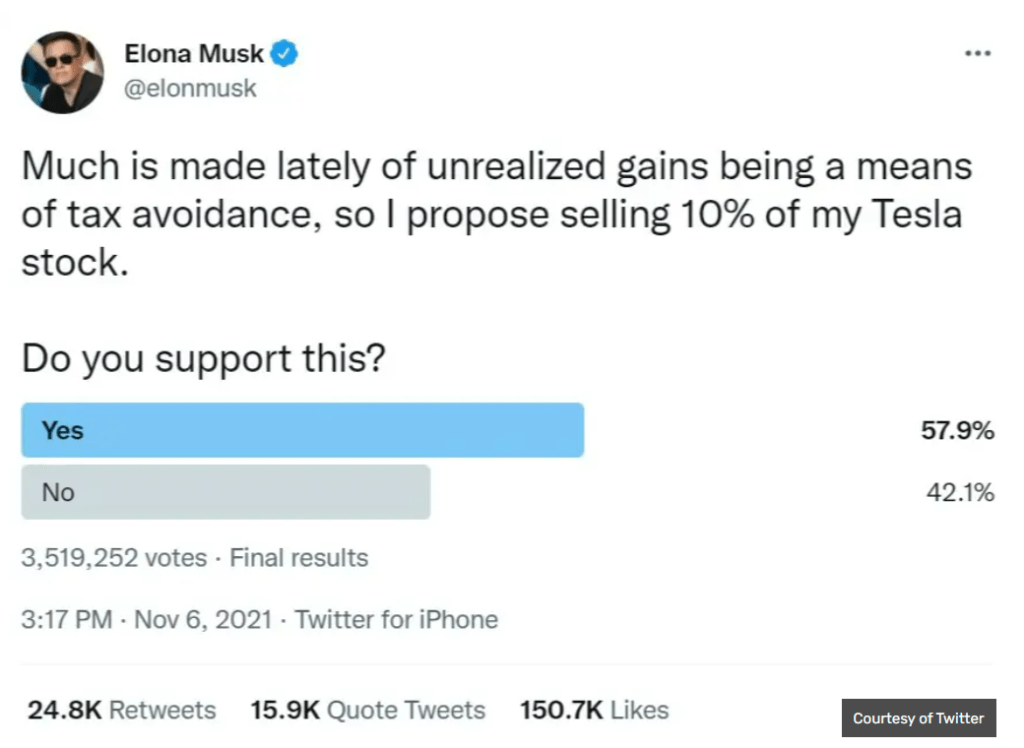

3. Ask voters

Musk asked his Twitter followers a question on November 6, 2021. “Much has been spoken recently about how unrealized gains can be used to avoid paying taxes, therefore I suggest selling 10% of my Tesla stock. Do you agree with this?

His poll received more than 3.5 million responses, with 57.9% of respondents saying they would back him in selling. Tesla’s pricing decreased by as much as 7.3% in reaction. Bloomberg estimates that 10% of Musk’s ownership at the time consisted of 170.5 million shares, or $21 million, the worth of stock.

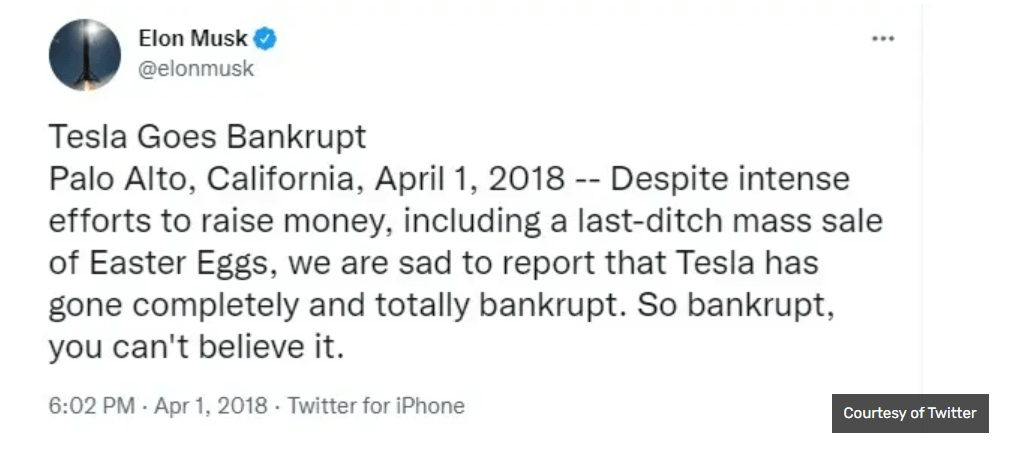

4. April Fools’ Day is a failure

January 1, 2018, Elon Musk sent out a tweet with the title “Tesla Goes Bankrupt” that appeared to be the first paragraph of a press release. The tweet said even a final desperate attempt to sell Hidden goodies didn’t help. ” We regret to announce Tesla’s complete and utter bankruptcy. It’s so insolvent you can’t believe it.

Even though it was April Fool’s Day, some investors were still slightly alarmed. The organization’s stock dropped $3 the day after the tweet prior to bouncing back.

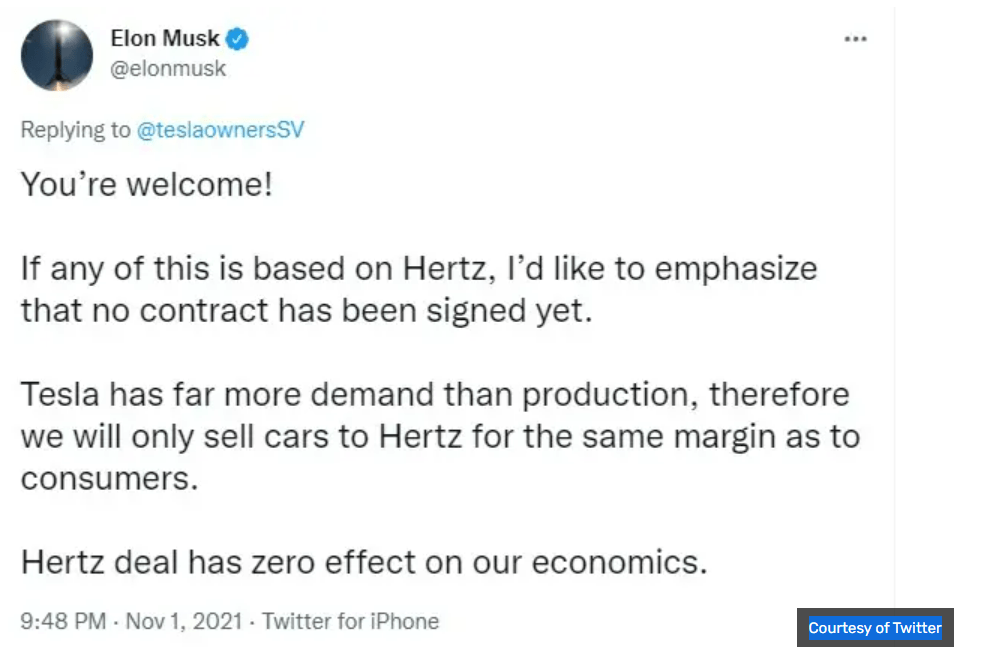

5. Apply brake force.

The rental company Hertz is known for its slogan, “Let’s go,” but a tweet Musk sent in late 2021 may have caused them to slow down.

Both Hertz and Tesla saw their stock prices rise after the rental car company announced that it would be purchasing 100,000 Teslas for its fleet. However, Musk tweeted, “If any of this is based on Hertz, I’d like to emphasize that no contract has been signed yet,” in response to a grateful investor.

We will only sell cars to Hertz at the same margin as consumers because Tesla has far more demand than production. In response to the tweet, the electric car manufacturer’s stock dropped nearly 4%.

6. Soaring High

Musk’s SpaceX company launched Starlink in 2019 to provide users with satellite-based internet access. Two years later, Musk tweeted, “Yes, we are talking to airlines about installing Starlink,” when asked if Starlink would be available on airlines. If you want it on your airliner, please tell them.

In trading, the shares of airline internet provider Gogo, which would compete with Starlink, dropped as much as 5%.

7. Privatisation

“Am considering taking Tesla private at $420,” Musk wrote in a tweet. Funding is now secure. on August 7, 2018, and as a result, Tesla’s shares increased by 6%.

However, the Securities and Exchange Commission found it to be inappropriate. A month later, in a statement, the government agency said that Musk’s tweet was false and disrupted the market. As part of a settlement for securities fraud, it fined Musk and Tesla $40 million.

8. He does not support Twitter

Musk said in a tweet in May 2022 that the Twitter deal was on hold, just one month after announcing his intention to purchase the company, after hemming and hawing about the company’s accurate data reporting.

It should come as no surprise that this announcement had a significant impact on the social media platform, as Twitter’s stock’s pre-market trading value decreased by 18%.

Then, Musk stated at the beginning of July that he would not be purchasing the social media giant. The effect was felt right away. On the day that Musk announced the termination of the agreement, Twitter’s stock closed the trading day at $36.81 per share, compared to $51.70 per share when Musk announced his intention to acquire the social media platform.